Average pay rose in June, in a boost to US employees – but a potential headache for the Federal Reserve.

In June, average hourly earnings rose by 12 cents, or 0.4%, to $33.58, ahead of expectations of a 0.3% rise.

Over the past 12 months, average hourly earnings have increased by 4.4%, ahead of expectations of a 4.2% annual rise.

That indicates earnings are rising ahead of inflation, which fell to 4% in May (we get June’s CPI inflation report next week).

Time for a recap

U.S. President Joe Biden has declared that June’s non-farm payroll report, showing continued, but slowing, job growth is “Bidenomics in action”.

In a statement, Biden declared:

“We are seeing stable and steady growth. That’s Bidenomics – growing the economy by creating jobs, lowering costs for hardworking families, and making smart investments in America.”

Nonfarm payrolls increased by 209,000 jobs last month, the smallest gain since December 2020, while April and May’s reports were revised down to show 110,000 fewer jobs created than expected.

Wage growth strengthened, rising 0.4% in the month. But there was also a rise in part-time work, suggesting demand weakened.

The US dollar has lost ground, and is now down 0.7% against a basket of currencies today, and at a two-week low against the yen.

Bond and equity markets are calm, after a volatile selloff on Thursday, with economists predicting US interest rates will be raised again later this month.

Charles Hepworth, investment director at GAM Investors, says:

“In the month of June, the US added 209,000 people to the non-farm workforce on the previous month. This number came in just under most forecasts of a 230,000 gain, but is still probably not what the Fed wants to see if it intends to continue pausing rate hikes.

“Average hourly earnings were also up more than expected, rising 0.4% on the month and showing a 4.4% advance year-on-year. The broader unemployment rate fell to 3.6%. The US economy looks far from softening. All these factors mean interest rate hikes are back on the agenda. We expect the Fed to raise rates at its meeting later this month.”

In other news today…

Travellers catching ferries from Dover faced queues of up to two hours on Friday as traffic built up at border posts.

The Kent port said passengers should expect waits of up to two hours for coaches and 90 minutes for cars, as traffic built up in the morning.

Ferries were operating normally, and passengers are allowed to catch subsequent sailings.

A combination of the sun, the start of school holidays in parts of the UK, and a school teachers’ strike offering parents a potential long weekend may have contributed to the pressure on the port.

UK house prices experienced their biggest annual fall in 12 years, according to Halifax.

Prices fell by 2.6% year-on-year, in the latest sign that soaring interest rates on mortgages is bringing a halt to the housing boom.

UK mortgage rates have continued to rise, as the financial markets expect UK interest rate to rise to 6.5% by early next year, up from 5% today.

Half of older adults who left the UK workforce amid mass redundancies in the first year of the Covid pandemic ended up falling into relative poverty, according to the Institute for Fiscal Studies (IFS).

The estimated £4.8bn cost of HS2’s endangered Euston terminus could balloon further unless the government becomes “clear what it is trying to achieve”, the public accounts committee has warned.

Air traffic control managers in mainland Europe are planning to strike this summer, potentially exacerbating disruption to holiday flights should French strikes continue.

South East Water, which left thousands of households without running water last month spent more on dividends and servicing its debt pile over two years than investing in infrastructure, it has emerged.

And….the last Ford Fiesta will leave the assembly line today, marking the end of an era for a model that sold 22m vehicles globally and is the UK’s all-time bestselling car.

Have a lovely weekend. GW

Here’s Erik Norland, Senior Economist at CME Group, on the jobs report:

“NFP surprised on the downside by 131K jobs net of revisions to previous months’ numbers, but the overall number wasn’t necessarily weak with wage growth surprising on the high side and unemployment, which is calculated from a separate survey, coming in at 3.6%. The economy still added 209K jobs in June.

Thursday’s JOLTS survey showed that there were 9.8 million job openings at the end of May, about three million than there were in late 2019 before the pandemic. This implies the possibility of strong demand for workers in the months ahead, even if economic activity slows in response to the Fed’s rate hikes.”

The US president has hailed June’s jobs report as evidence that “Bidenomics” is working, delivering sustainable economic growth.

In a statement just issued by the White House, Joe Biden says:

This is Bidenomics in action: Our economy added more than 200,000 jobs last month—for a total of 13.2 million jobs since I took office.

That’s more jobs added in two and a half years than any president has ever created in a four-year term. The unemployment rate has now remained below 4% for 17 months in a row—the longest stretch since the 1960s. The share of working-age Americans who have jobs is at the highest level in over 20 years. Inflation has come down by more than half.

We are seeing stable and steady growth. That’s Bidenomics—growing the economy by creating jobs, lowering costs for hardworking families, and making smart investments in America.

This chart shows pretty clearly that US job creation is in a downward trend, once you account for the downward revisions to the April and May jobs reports:

The White House Council of Economic Advisers have tweeted their views on today’s US jobs report – which they argue shows more jobs created than you’d normally expect.

The stronger-than-expected wage growth in June suggests that US firms were prepared to sign off pay rises for workers, or paying more for new staff.

In other words, demand for workers remains “robust”, says Greg Wilensky, head of US fixed income at Janus Henderson Investors:

“June’s nonfarm payrolls growth of 209,000 came in slightly below consensus expectations of 230,000. The unemployment rate ticked down to 3.6% from 3.7% in May, while the labor force participation rate held steady at 62.6%. While this is the lowest monthly gain in jobs since the pandemic, this level of growth remains congruent with a strong labor market.

Notably, Average Hourly Earnings rose more than expected in June, another signal that demand for labor remains robust.

In our view, there is nothing in the data that would cause the Federal Reserve (Fed) to hit the brakes on a rate hike in July. The labor market continues to show sufficient strength that we expect the Fed to follow through with another 25 basis point rate hike in July, and make few changes to its previous statements regarding the strength of the labor market.

Looking forward to the likelihood of a September rate hike, we think that decision will largely be driven by data releases between now and then.”

Futures trading indicates there is a 90% chance that the Federal Reserve lifts rates at its meeting later this month, having paused in June.

That’s according to the CME FedWatch Tool.

Wall Street has opened in the red.

This suggests investors anticipate that the Federal Reserve will raise US interest rates higher, given the resilience in the US joba markets.

The Dow Jones Industrial Average, which tracks 30 large US companies, fell 85.19 points, or 0.25%, at the open to 33,837.07.

The broader S&P 500 opened 7.05 points lower, or -0.16%, at 4,404.54, while the tech-focused Nasdaq Composite lost 10.98 points, or almost 0.1%, to 13,668.07 at the opening bell.

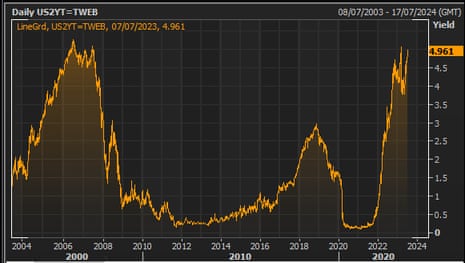

US short-term government bonds have recovered some of their earlier losses, after the jobs report was released.

This has pulled the yield, or interest rate, on 2-year Treasury Bills down to 4.98%. That’s back below the 5% mark hit yesterday for the first time since March, as yields hit 15-year highs.

Yields rise when bond prices fall, and the recent surge in yields follows increases in US interest rates and expectations of further rises to fight inflation.

There was also a rise in Americans being moved onto part-time work due to weakening demand in June, the jobs report shows.

The number of people employed part-time for economic reasons increased by 452,000 to 4.2 million in June.

This “partially” reflects an increase in the number of people whose hours were cut due to slack work or business conditions, the report says, even though they would have preferred full-time employment.

Today’s jobs report is “slightly weaker” than many expected, says Richard Flynn, managing director at Charles Schwab UK.

The labour market remains tight, but investors will likely interpret these numbers as a sign that cracks are beginning to emerge. As wage growth is yet to substantially ease, the Fed will likely feel continued pressure to maintain high interest rates. When inflation remains an issue for the US economy, slower and weaker pay growth will make it easier for the Fed to maintain price stability.”

John Leiper, chief investment officer at Titan Asset Management, agrees that today’s jobs report is “very different” than previous months.

Non-farm payroll came in below expectations for the first time in a year and revisions to the two prior readings remove another 110,000 jobs. Despite fewer jobs, the unemployment rate fell.

In summary, 209,000 additional jobs is still strong, unemployment is historically low and average hourly earnings rose. It was interesting to see, given weakness in the sector, that manufacturing employment actually rose.

Bottom line, despite the noticeably softer number versus yesterday, which is catalysing a rebound in risk sentiment, this doesn’t detract from the narrative that the Fed has more work to do on rates.’

A 209,000 increase in payrolls can “hardly be described as weak”, argues Seema Shah, chief global strategist at Principal Asset Management.

Jobs growth has slowed but remains too strong to justify an extended Fed pause. More significantly, with average hourly earnings surprising to the upside, wage pressures are still too strong. Today’s report will give the Fed little reason to hold off from hiking at the July meeting.

“Now attention will turn to next week’s CPI report. Without a slowdown in monthly core inflation, market focus may start turning to whether rate hikes will persist into September and, from there, questioning how much more monetary tightening the U.S. economy can realistically take before something breaks.”

Hugh Grieves, fund manager of the Premier Miton US Opportunities Fund, says America seems to be avoiding falling into an often-predicted recession:

“US workers continue to be in strong demand as the American economy remains remarkably resilient, adding 209,000 workers to the national payroll in June, despite the Federal Reserve’s best efforts to apply the brakes.

With the unemployment rate remaining at just 3.6%, employees are in short supply resulting in workers’ hourly wages now rising faster than headline inflation. With numbers like these, a recession looks improbable any time soon.”

The US economy added 209,000 new jobs in June as hiring slowed, our US business editor Dominic Rushe reports.

The rise was lower than the 240,000 jobs economists had expected and lower than the 309,000 jobs added in May.

But the gain was the 30th consecutive month of jobs gains and the unemployment rate ticked down to the historically low rate of 3.6%.

The US job market has remained robust despite the Federal Reserve’s aggressive attempts to slow the economy and tamp down inflation with more than a year of interest rate hikes.

The Fed chair, Jerome Powell, has indicated that the central bank is likely to raise rates again this month after announcing a pause in June. More here….

Disappointingly, US job growth in April was weaker than previously thought.

Today’s payroll report shows that April’s data has been revised down by 77,000, from +294,000 to +217,000.

Include May’s downward revision of 33k, and this means 110,000 fewer jobs were created in these two months than first reported.

These revisions aren’t unusual – NFP reports are typically adjusted after their first release. But it does raise questions over whether the strength of the labor market has been overstated..

The US dollar has weakened slightly, following the news that US job growth was lower than expected in June.

Against a basket of currencies, the dollar is down 0.3% today, while the pound is up half a cent against the greenback at $1.2788.

Average pay rose in June, in a boost to US employees – but a potential headache for the Federal Reserve.

In June, average hourly earnings rose by 12 cents, or 0.4%, to $33.58, ahead of expectations of a 0.3% rise.

Over the past 12 months, average hourly earnings have increased by 4.4%, ahead of expectations of a 4.2% annual rise.

That indicates earnings are rising ahead of inflation, which fell to 4% in May (we get June’s CPI inflation report next week).

Print

Print