The Ethereum network gas fees spiked to $3.52 over the past week, marking a recovery from earlier this month, when the average transaction fee hit a 4-year low.

The spike in gas fees has triggered a rise in Ether tokens burned from 80 ETH to 1,360 ETH.

Despite this surge in average transaction fees, Ethereum active addresses declined to a year-to-date low. However, the price of Ether surged, gaining over 14% in less than seven days.

Ethereum Transaction Gas Fees Spike by 314% To $3.52

In a September 23 tweet, crypto analyst Kyledoops revealed that the average transaction fee on the Ethereum network rose by 314% to reach $3.52. This marked a significant increase following a slump to a four-year low in early September.

Ethereum maintained a transaction fee above $1 before the PoS transition, blob upgrades, and the advent of the Bored Ape Yacht Club NFT collection. However, as of September 1, the average gas fee hovered around $0.85, the lowest since July 2020.

Ethereum’s transaction fees skyrocketed, with the seven-day moving average hitting $3.52—a 314% jump from $0.85 on September 1.

On September 21, daily $ETH burning soared to 1,360, a staggering 1,600% increase from 80.27 on September 1.

Yet, active accounts on the Ethereum… pic.twitter.com/BPWhuPUyoZ

— Kyledoops (@kyledoops) September 23, 2024

The recent surge in ETH transaction fees stems from increased gas consumption by specific smart contracts and overall network congestion. Over the past 30 days, Uniswap led the top gas-consuming smart contracts on the Ethereum blockchain.

Others include Uniswap’s V2 variant and Telegram-based crypto trading bots Maestro and Banana Gun. Some crypto trades, especially those involving Tether (USDT) and USD Coin (USDC), contributed to the spike in gas fees.

The overall change indicates more user completing their transactions on the Ethereum network.

Alongside the transaction fee increase, Ethereum also recorded a surge in ETH’s burn rate. Kyledoops noted that Ether’s daily burn rate increased to 1,360 coins on September 21. This figure represents over a $1,600% increase compared to 80.27 ETH tokens burned early this month.

Ethereum’s EIP-1559 upgrade introduced a burning mechanism to the network. This process aims to control the Ether’s supply over time by removing a certain percentage of its transaction fees.

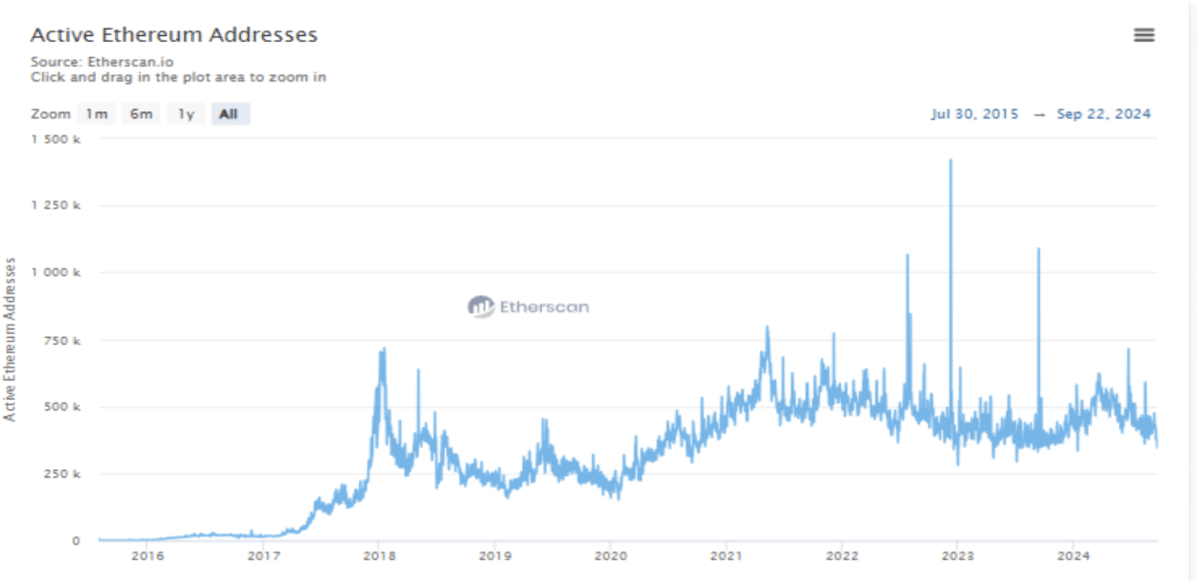

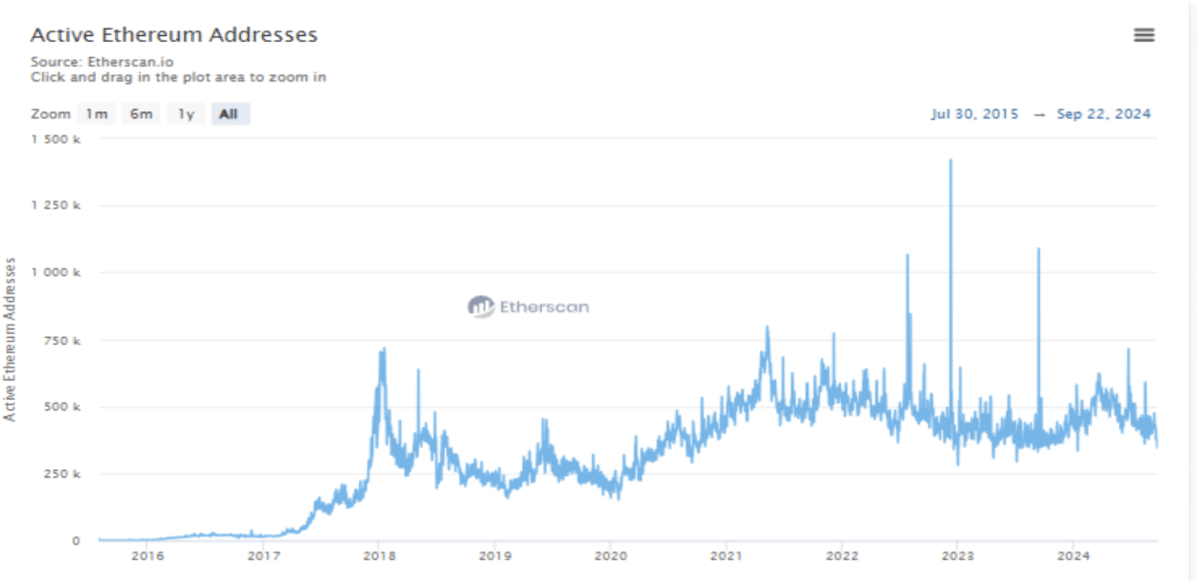

Ethereum-Based Active Accounts Slipped To Year-To-Date Lows

Amid the surge in Ethereum transaction fees, the network’s active accounts have slipped significantly. According to data from Etherscan, the active Ethereum addresses have hit a year-to-date (YTD) low of 385,000.

The data indicated that the network’s seven-day moving average of active accounts declined by 11% from its figure at the beginning of September. The current position marks Ethereum’s lower value since December 1, 2023.

The increasing transaction fees could be the reason for the drop in active addresses as users seek cheaper alternatives. Ethereum has come under intense scrutiny following this gas fee spike. According to Matt Hougan, Bitwise CIO, “No one likes Ethereum right now.”

Moreover, the ETH/BTC ratio, which measures the variation between Ethereum and Bitcoin prices, declined to a three-year low.

Despite this, Ether has gained over 14% since last Wednesday. The generally positive crypto market sentiment following the US Fed’s rate cut could be responsible for this rally. ETH trades at $2,646, a 3.35% 24-hour increase.

Disclaimer: The opinions expressed in this article do not constitute financial advice. We encourage readers to conduct their own research and determine their own risk tolerance before making any financial decisions. Cryptocurrency is a highly volatile, high-risk asset class.

Our Editorial Process

Our Editorial Process

Print

Print