Of Course Netflix’s Ted Sarandos Wants Streaming Rivals to Be ‘Transparent’ About Viewing Data — It Would Show His Massive Lead

It’s good to be the king.

Ted Sarandos, co-CEO of Netflix, sits atop an industry-leading paid subscriber count of nearly 280 million worldwide. This week, Sarandos spoke at the Fast Company Innovation Festival in New York and previewed Netflix’s latest gigantic data dump on Thursday — its biannual “Engagement Report” showing views and total viewing hours for 99% of the content on the platform.

In aggregate, Netflix customers streamed 94 billion hours of programming in the first half of 2024. That’s up just a hair from 93 billion a year earlier, but it’s still up. “I don’t think we could be any more transparent than this,” Sarandos said at the conference. “I’m hoping that the other folks in the business will follow suit.”

Well, no kidding. Sarandos would love for Prime Video, Hulu, Disney+, Max or any other streamer to put numbers out revealing virtually all viewing of their users — because it would lay bare just how wide the gulf is between Netflix and anyone else.

Popular on Variety

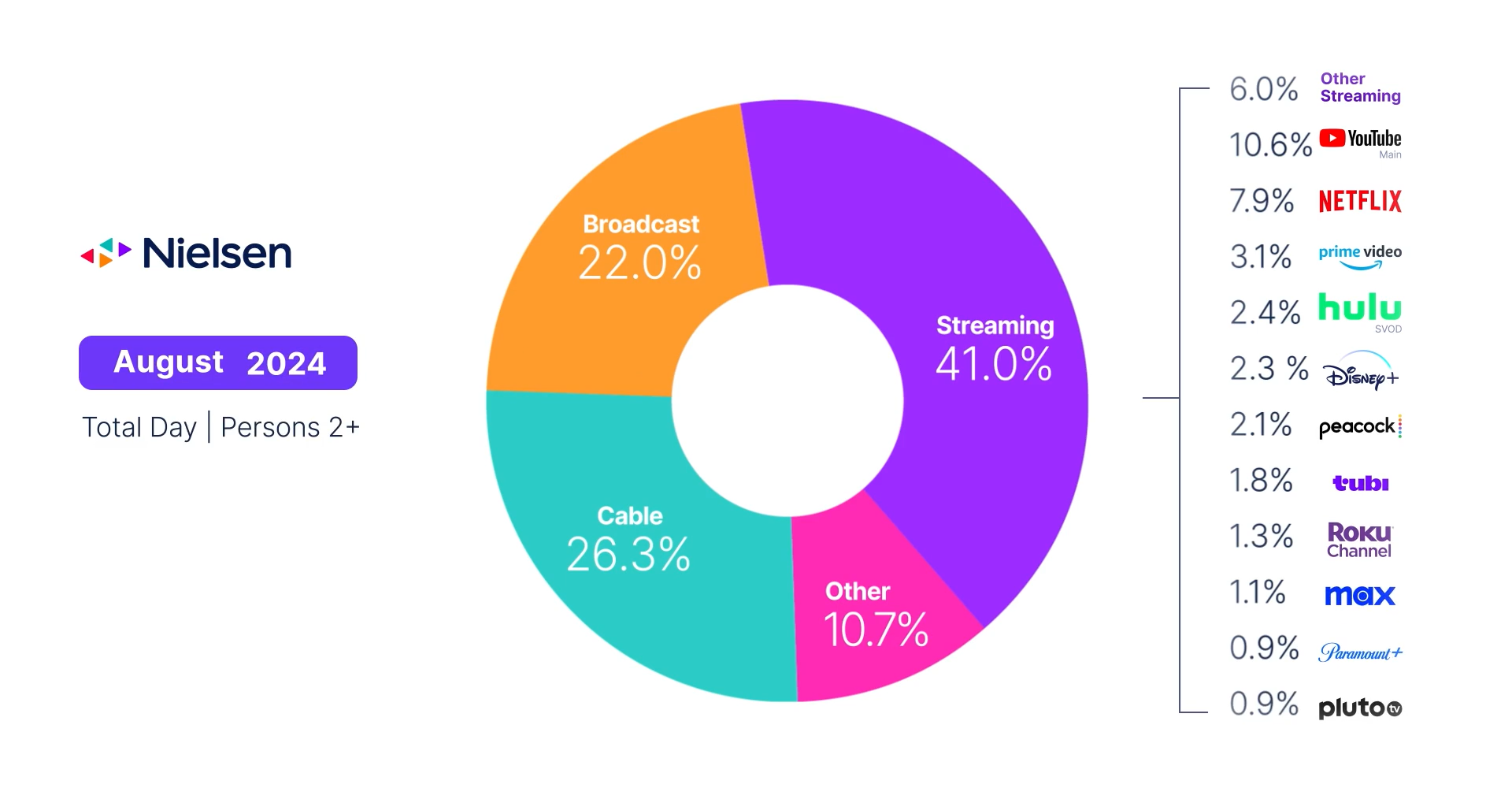

Note that Netflix’s biannual “Engagement Report,” which it first released for the second half of 2023, and its Top 10 lists are based on self-reported data that is not verified by a third party. But independent Nielsen data (although it covers only the U.S.) has regularly shown Netflix’s share of total TV viewing is at least twice that of its next closest rival, Amazon’s Prime Video.

Here is Nielsen’s estimate for August 2024, projected based on its measurement panels for TV households (including on internet-connected TVs). Even with a 39% lift in share of NBCU’s Peacock, thanks to the 2024 Paris Olympics, Netflix remained the subscription-video leader by a substantial margin:

Other streamers, like Warner Bros. Discovery’s Max and Disney’s Hulu, have adopted most-viewed lists like Netflix. But no one else is likely to disgorge a massive viewing breakdown in the way Netflix has; there’s just no upside. To date, Netflix rivals have selectively released viewing metrics to tout the performance of hit titles (for example, Amazon’s claim that the “Fallout” series garnered 65 million viewers in its first 16 days on Prime Video).

Meanwhile, recall that Sarandos was against releasing such granular data, before he was for it. In discussing Netflix’s Q3 2023 earnings last October, he said this: “At the time we started creating original programming, our creators felt like they were pretty trapped in this kind of overnight ratings world and weekend box office world defining their success and failures.” But, he added, Netflix was “leading the charge” on Top 10 viewing data and that he expected the industry to become “more and more transparent.”

Two months later, Sarandos happily announced Netflix’s first big massive data drop, which for the first time included licensed titles. One driver was the SAG-AFTRA and WGA strikes, in which great access to viewing data was a key bargaining issue. “This is probably more information than you need,” Sarandos told reporters, “but I think it creates a better environment for the guilds, for us, for the producers, for creators and for the press.”

At the Fast Company event, Sarandos elaborated on Netflix’s thinking. The “Engagement Report” is “kind of an answer to folks who were saying, ‘Hey, I don’t really get to see how my stuff does.’ And I agree that was unfair,” Sarandos said.

Clearly, though, a big reason Netflix felt comfortable unlocking as snapshot of its trove of Big Data was to show its major reach and engagement. With its primacy in the market, Netflix has set the model for compensating filmmakers and talent who produce its original programming. “We are mutually dependent. We need great storytellers,” Sarandos said. “My goal is, they all get rich and famous… if they do their job really really well, they will.”

Netflix’s Most-Viewed TV Shows in First Half of 2024: ‘Fool Me Once,’ ‘Bridgerton,’ ‘Baby Reindeer’

According to Sarandos, the company pre-negotiates the value of content deals for a TV show or movie based on “how we think it will perform” and “pay them accordingly.” That’s better for creators, he argued, because “the risk shifts to us.” He continued: What about the “Titanic” phenomenon, when “there’s gigantic upside”? “It’s so rare when that happens,” Sarandos said, before claiming that “in many cases we’re paying as if that happens every single time.”

“Whenever there’s change,” Sarandos said, “people get uncomfortable.”

As for YouTube supposedly representing Netflix’s chief rival in the streaming wars, Sarandos pointed out that the two companies have very different business models and curate very different kinds of content. Indeed, he said, YouTube serves as a great outlet for Netflix’s trailers. “Between us we get 20% of all viewing,” he said at the Fast Company conference. “What I’m doing is going after the 80% that is not on us or YouTube.”

During his FC talk, Sarandos also recalled the famous diss of Netflix in 2010 by Time Warner CEO Jeff Bewkes. “It’s a little bit like, is the Albanian army going to take over the world? I don’t think so,” Bewkes said in an interview with the New York Times. (The barb has long rankled the Netflix crew: In 2013, after the company became the first streaming platform to garner major Emmy nominations, co-founder Reed Hastings posted on Facebook: “Albania takes it up a notch.”)

Sarandos said Bewkes’ cutting remark “really served as fuel” to motivate Netflix to win. “Nothing fires up a team like being called ‘the Albanian army,’” he chuckled.

Print

Print