Forex Analyst – Bitcoin Spikes to $63K Due to Fed Slashing Interest Rates & Trump’s Crypto Exchange

- This week, the Federal Reserve System (Fed) cut interest rates by 50 basis points, and the Trump family launched a crypto exchange.

- A forex analyst from FTXM cites that both these developments could boost crypto appetite; Bitcoin’s price has spiked by 12% over the last four days.

- Other major cryptos ($SOL, $ETH, $BNB) and the Coinbase exchange have also appreciated.

Bitcoin rallied ~12% in four days, hitting $64K following macroeconomic events. A coincidence? Lukman Otunga (senior market analyst at forex trading broker FTXM) thinks not.

Otunga believes the crux of crypto’s uplift is the US Fed interest rate cut and possibly Trump’s recently launched crypto exchange.

The Fed slashed interest rates by a half point on Wednesday, and the Trump clan launched ‘World Liberty Financial’ the day before.

$BTC is no stranger to experiencing highs and lows following the latest headlines. This time around, the crypto market is gaining the upper hand. But what’s the connection?

Americans Have More Capital for Riskier Assets

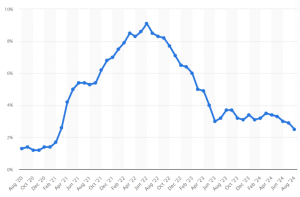

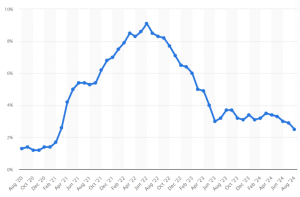

The Fed cut interest rates for the first time in four years (by 50 basis points) following a long period of instability.

According to Statista data (based on the consumer price index), US interest rates increased by 7.8% between August 2020 – June 2022 and 2.5% from August 2023 – August 2024.

Halving US interest rates is anticipated to stimulate economic growth. It makes borrowing funds cheaper and could boost investments in riskier assets, like crypto.

On top of this, Otunuga believes the Trump family’s crypto platform might assist $BTC’s uptick – wildly if he beats Kamala Harris in the presidential elections on November 5.

However, the platform (which is said to simplify crypto trading and aid the unbanked) has notably been criticized, particularly in relation to capitalism.

After once deriding cryptocurrency as a “scam,” former Pres. Trump formally threw his support behind World Liberty Financial, raising questions in political and economic circles with its launch ahead of Election Day.

ABC News’ @eschulze reports.https://t.co/xvjlTL0z3v pic.twitter.com/i5U5RQJQll

— ABC News Live (@ABCNewsLive) September 18, 2024

The Crypto King Perks Up the Crypto Market (Again)

Coinciding with the current affairs, $BTC rose by ~12% over four days, from its $57K low to a $64K high (a ~134% year-to-date increase).

It’s not just $BTC that’s winning. MicroStrategy (which holds over 244K $BTC and plans to invest in more) has witnessed its shares spike by ~10% over the last week.

And as usual, when the king of crypto rises, others follow. Over the last 24 hours, $SOL, $ETH, and $BNB have appreciated by 9%, 5%, and 3%, respectively.

Further signaling enhanced crypto interest is Coinbase (the fourth-largest crypto exchange), which has climbed 3.5% since yesterday.

Final Thoughts – Is Crypto’s Moment of Glory Long-Lasting?

Bitcoin’s sudden rise signals a turning point, perhaps driven by the Trump family’s crypto initiative and the Fed’s interest rate cut.

Trump’s crypto exchange attracts significant media attention, especially as he’s vying against Kamala Harris for the presidential seat in just 46 days.

On the other hand, the Fed’s half-point interest rate reduction might spur more Americans to invest in riskier assets like crypto because they have more money in their pockets.

However, we advise remaining cautious because sudden market changes historically cause price hurdles. Otunago also believes that ‘if the Fed expresses concerns over the US economy, Bitcoin could fall.’

Whether short-lived or not, many investors still think that now is an opportune time to get involved in crypto because of the positive market dynamics.

References

Disclaimer: The opinions expressed in this article do not constitute financial advice. We encourage readers to conduct their own research and determine their own risk tolerance before making any financial decisions. Cryptocurrency is a highly volatile, high-risk asset class.

Our Editorial Process

Our Editorial Process

Print

Print